When you first enroll in Medicare during your Initial Enrollment Period, you will select Original Medicare (Parts A and B) or a Medicare Advantage plan (Part C) which combines the two types of coverage. Part D (prescription drug) coverage is also available with either of these options.

But once you make your selections, you aren’t stuck with those plans for life. In fact, Medicare offers you opportunities to change your plan(s), depending upon the situation.

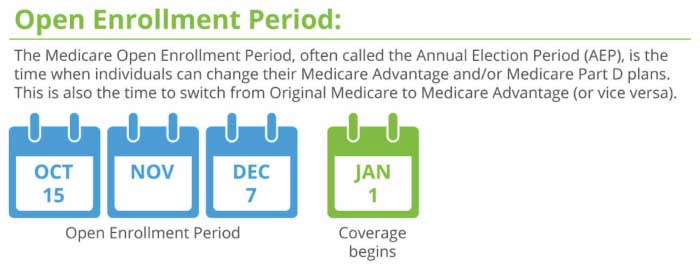

Medicare’s Annual Enrollment Period (AEP)

Once you have enrolled in Medicare, you do have the right to review your plan selections and make changes each year. From October 15 to December 7, you can take advantage of the Annual Election Period to make changes to Part C (Advantage) or Part D (prescription) plans.

At this time, you can:

- Change from Original Medicare to a Medicare Advantage plan

- Drop a Medicare Advantage Plan and go back to Original Medicare

- Change from one Medicare Advantage plan to a different one

- Enroll in a Part D prescription drug plan

- Cancel your Part D prescription drug plan

- Change your Part D prescription drug plan

Medicare Advantage Open Enrollment

In the event that you change your mind about a Medicare Advantage Plan for any reason, the Medicare Advantage Open Enrollment Period from January 1 to March 31 gives you the opportunity to make changes.

During this time you can:

- Switch from one Medicare Advantage plan to another

- Drop Medicare Advantage and return to Original (Parts A and B) Medicare

- Add a Part D prescription plan

- Drop a Part D prescription plan

Yes, you can drop a Medicare Advantage plan and return to Original Medicare, but don’t count on a Medigap plan if that is your intention. Remember that carriers will screen you and can choose not to enroll you.

What if you need to make changes to your plan outside of these times?

In certain situations, such as a move or loss of coverage, you might qualify for a two-month Special Enrollment Period. During this time you can make changes to your Medicare plan(s).

For example, moving from one geographic area to another might qualify you for a Special Enrollment Period, if your network is not available at your new home.

During your SEP, you can switch to a new Medicare Advantage plan or Part D plan, or return to Original Medicare without penalty. In some situations you might also be able to enroll in a Medigap plan without the requirement for medical underwriting (called guaranteed issue rights).

If you believe you might qualify for a Special Enrollment Period, you should contact your plan administrator as soon as possible after the qualifying event. We can assist you with this process.

Doreen DannDLD Healthcare Consulting & Insurance

- To speak with a licensed agent, call (714) 766-0234

(TTY 711 M-SU, 8am-8pm)

- License #0M46311

Have You Watched Our Medicare Essentials Video Quick-Course?

This video tutorial covers the basic elements of Medicare in a format that is easy to understand and you can watch it from the comfort of home! It’s yours at no cost and no obligation, just tell us where we should send it!

Get Free Medicare Assistance

Friendly, licensed professionals are available to answer all of your questions. Call (714) 766-0234 or complete the form below and we’d be happy to reach out to you.